The statistics show that there has the same thing between Singapore and Hong Kong's real estate price for the past 2 years.

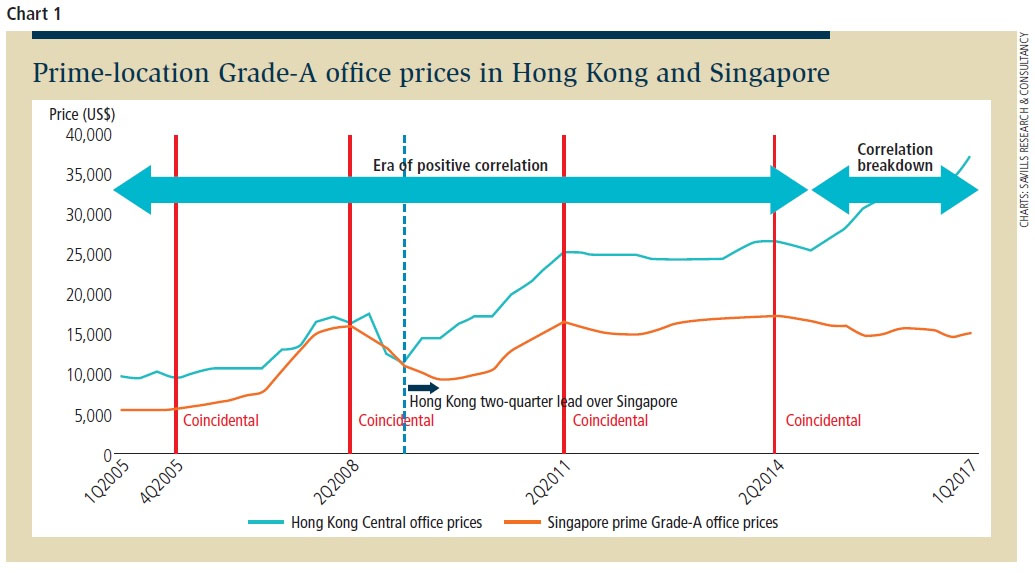

Although people often said that Singapore property price decrease about two-quarters in comparison Hong Kong' price, it can be correct or incorrect. This depends on the Hong Kong dollars rate of exchange in every period. For instance, in 1St Quarter 2009, the price of Hong Kong led Singapore by two-quarter. (Chart 1 )

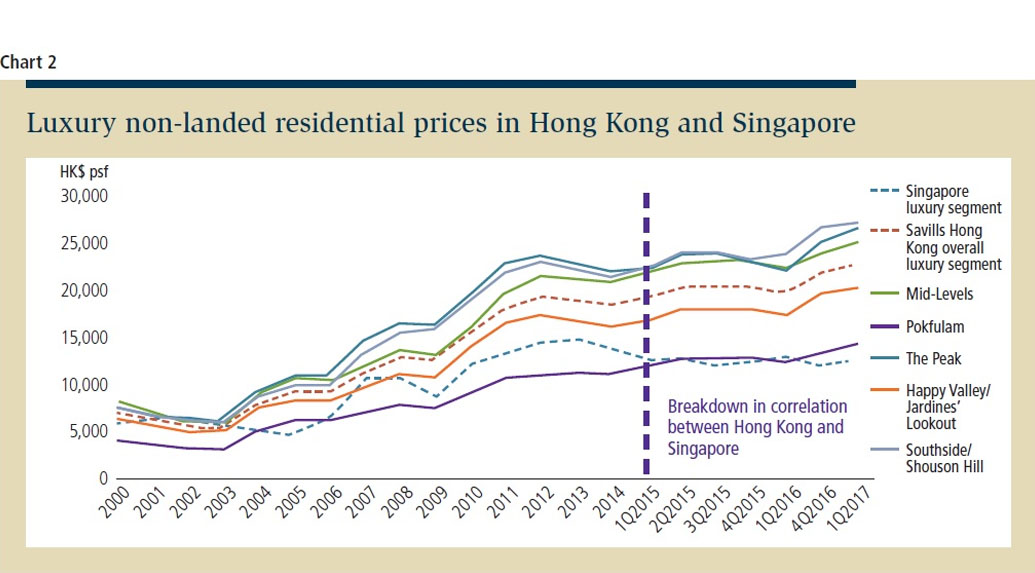

The other segment, for non-landed, both Singapore and Hong Kong price were the same from 2000 to 4th Quarter 2014. Then, Hong Kong's price increase but Singapore is in stability situation (Chart 2). The government of 2 nations promulgated the policies to stabilize the real estate market.

Grade A office space

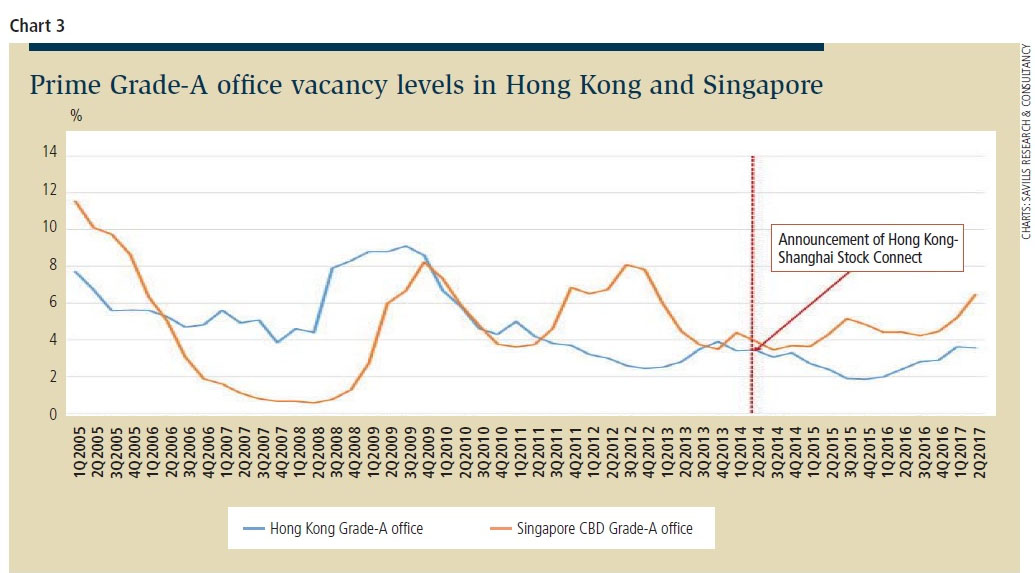

Since the mid of 2014, when Chinese Premier published the establishment of Hong Kong-Shanghai Stock Connect, the Chinese financial companies appear more and more. This promotes the demand of looking office in Hong Kong immediately. Before, the Hong Kong office price is high as Singapore office price (Chart 3).

Table 1: Tech firms in Hong Kong & Singapore

| Firm | Country of origin | Area occupied in Hong Kong sqft) | Area occupied in Singapore sqft) |

| US | 16,500 | 45,000 | |

| US | 21,900 | 350,000 | |

| Alibaba | China | 34,400 | 10,000 |

| US | 50,500 | 300,000 |

(Includes additional space at Marina One (by-end-2018)

For tenant profile, Hong Kong and Singapore have the difference clearly. Singapore attracted much more technology enterprises, and most of the tech companies came from Western.

On the contrary, Hong Kong attracted less the tech firm than Singapore, here, the majority is Chinese tech companies (Table 1).

When Hong Kong-Shanghai Stock Connect announced, Hong Kong has a huge need from Chinese and Taiwanese financial companies. but Singapore has no Chinese enterprises, just only Bank of Communication at Singapore Land Tower in Raffles Place (Table 2).

In China, the non-financial companies raised their segment in leasing. In Singapore, the offices are leased by tech companies, co-working space provider, shipping, marketing and Grab.

At this time, plenty of Western co-working space operators that developed in both 2 cities. For instance, WeWork, this company opened their office in Hong Kong with the total land site is 150,000sqft, in Singapore, it's close to 100,000 sqft.

Table 2: Recent leasing activity by Chinese & Taiwanese financial institutions in Hong Kong

| Firm | Office Address | Size (sqft) |

| Huarong | One Pacific Place, Admiralty Two Pacific Place, Admiralty |

22,500 41,600 |

| China Orient Asset Management | One IFC, Central | 18,200 |

| Bank of Shanghai (HK) | Three Garden Road - Champion Tower, Central | 17,800 |

| Bank of Communications | New World Tower One, Central | 10,400 |

In conclusion, office demand space in Hong Kong comes from Chinese companies and co-working space provider from Western, while in Singapore, the demand comes from the Western and Japanese enterprises.

Residential

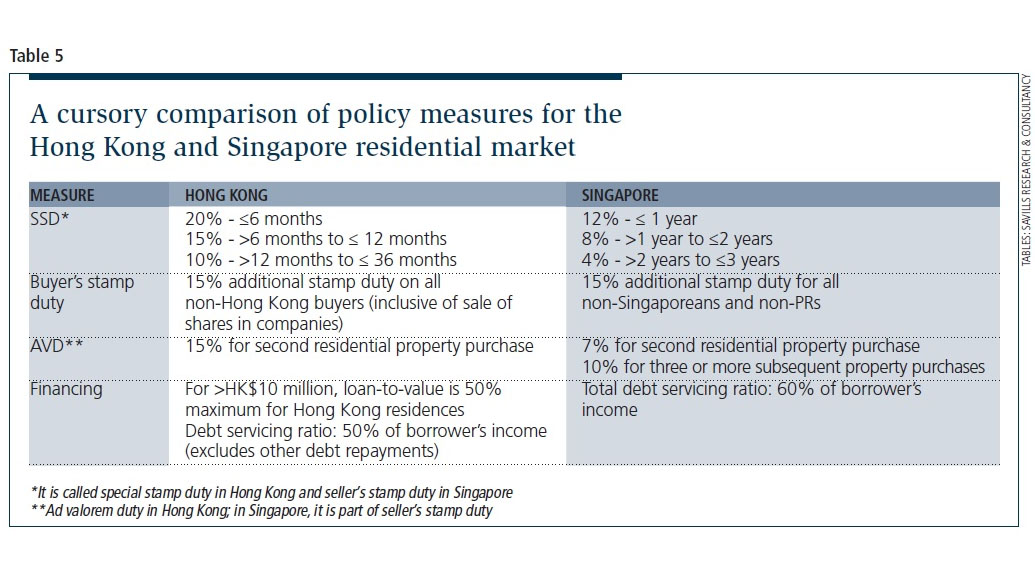

As I mentioned at the beginning, both Singapore and Hong Kong's government promulgated the policies that limited land speculation (Table 5). However, Hong Kong has tightened the finance of the bank to the developer who linked to banks to offer loans for the tenant. But Singapore has not. Besides, the price of property in Hong Kong increase sharply in the recent years, Singapore's tend to decrease.

The prices in residential and office markets in Hong Kong is predicted to continue rising next time.

Singapore and Hong Kong have their developmental strategy by a different leading. This is the precious opportunity for the investors, both oversea and domestic developers to enforce the impressive strategy and fetch the benefit.

Adapt from The Edge Property July 25, 2017.